Older homeowners are increasingly accessing wealth from their properties through equity release. In 2018, 50p of housing wealth was unlocked for every £1 of flexible pension payment, highlighting the role of property wealth to finance later living.

The lifetime mortgage market saw the biggest annual increase in new loans compared to other mortgage market sectors for the 3rd consecutive year. Between July 2018 and December 2018, 44,000 homeowners aged over 55 years, accessed money from the value of their property.

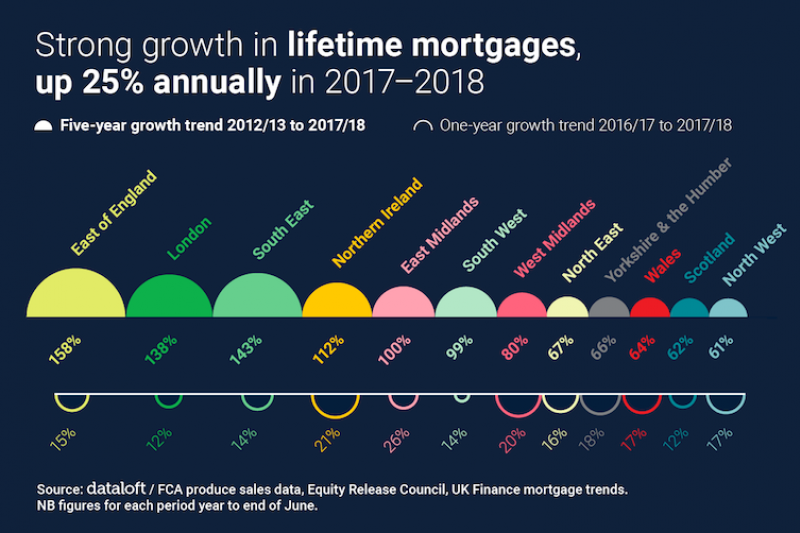

Over the past five years, London and southern regions including the East of England, the South East and South West, experienced the strongest growth in consumer demand.

More recently the East Midlands, West Midlands and Northern Ireland have seen the greatest increase in demand for lifetime mortgages, numbers rising by over 20% between 2016/17 and 2017/18.